2014 Is Turning Out To Be Eerily Similar To 2007

- we remember precisely what followed.

It was the worst economic crisis since the days of the Great Depression -

- we remember precisely what followed.

It was the worst economic crisis since the days of the Great Depression -

Many bankers have been killed. They should be those who tried to uncover apparent rigging in the stock market and in particular, manipulation of gold price. Such cover-ups will not last forever. General investors are ignorant just like the public who are deceived by the mass media. They do nothing but invest money on the faith of stock price valuation by their favorite critics and economic newspapers. The moment they know the truth, what will happen? It would be a frightening thought. I have told you for a long time that the next economic collapse would be so serious that could cause the downfall of nations. Such thing is a common-sense view. Strangely enough, however, “nobody is talking about this in despite of such imminent crisis.”

Masatoshi

Takeshita

April

24, 2014

Excerpt from a Japanese article: Trend of Japan, World and Space – April 24, 2014 –

2014

Is Turning Out To Be Eerily Similar To 2007

(Source)

The similarities between 2007 and

2014 continue to pile up. As you are about to see, U.S. home sales fell dramatically throughout 2007 even

as the mainstream media, our politicians and Federal Reserve Chairman Ben Bernanke promised us that everything was going to be just fine and that we

definitely were not going to experience a recession. Of course we remember

precisely what followed. It was the worst economic crisis since the days of the

Great Depression.

And you know what they say – if we do not learn from

history we are doomed to repeat it. Just like seven

years ago, the stock market has soared to all-time high after all-time

high. Just like seven years ago, the authorities are telling us that there is

nothing to worry about.

Unfortunately, just like seven years ago, a housing

bubble is imploding and another great economic crisis

is rapidly approaching.

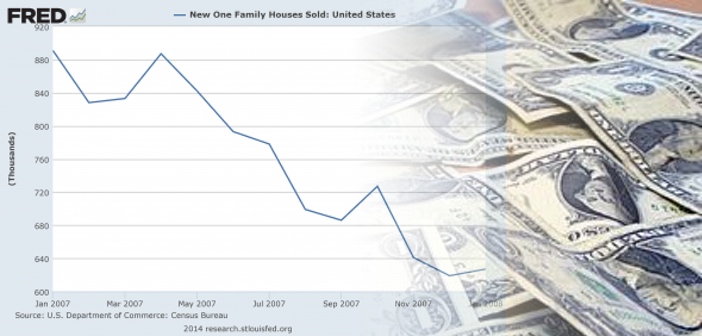

Posted below is a chart of existing home sales in the

United States during 2007. As you can see, existing home sales declined

precipitously throughout the year…

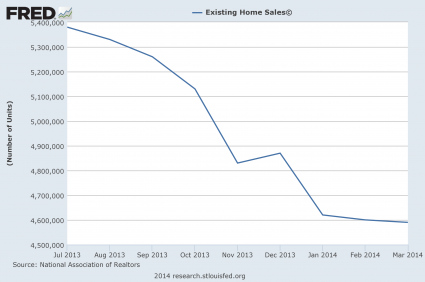

Now look at this chart which shows what has happened

to existing home sales in the United States in recent months. If you compare

the two charts, you will see that the numbers are eerily similar…

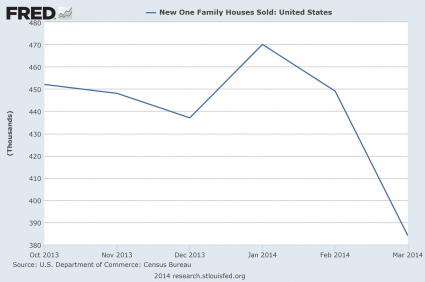

New home sales are also following a similar pattern.

In fact, we just learned that new home sales have

collapsed to an 8 month low…

Sales of new single-family homes dropped sharply last

month as severe winter weather and higher mortgage rates continued to slow the

housing recovery.

------------ .

Once again, this is so similar to what we witnessed

back in 2007. The following is a chart that shows how new home sales declined

dramatically throughout that year…

And this chart shows what has happened to new homes sales during the past several months. Sadly, we have never even gotten close to returning to the level that we were at back in 2007. But even the modest “recovery” that we have experienced is now quickly unraveling…

If history does repeat, then what we are witnessing right now is a very

troubling sign for the months to come. As you

can see from this chart, new home sales usually start going down before a recession begins.

And don’t expect these housing numbers to rebound any

time soon. The demand for mortgages has dropped through the floor. ---------- …

One of the key indicators I follow in respect to the

state of the housing market is mortgage originations. This data gives me an

idea about demand for homes, as rising demand for mortgages means more people

are buying homes. And as demand increases, prices should be increasing.

But the opposite is happening…

In the first quarter of 2014, mortgage originations

at Citigroup Inc. (NYSE/C) declined 71% from the same period a year ago. ----------

Total mortgage origination volume at JPMorgan Chase

& Co. (NYSE/JPM) declined by 68% in the first quarter of 2014 from the same

period a year ago.----------

It is almost as if we are watching a replay of 2007

all over again, and yet nobody is talking about this.

Everyone wants to believe that this time will be

different.

The human capacity for self-delusion is absolutely

amazing.

There are a lot of other

similarities between 2007 and today as well.

Just the other day, I noted that retail stores are closing in the United States at the

fastest pace that we have seen since the collapse of Lehman Brothers.

Back in 2007, we saw margin debt on Wall Street spike

dramatically and help fuel a remarkable run in the stock market. Just check out

the chart in this article. But that spike in margin debt also made the eventual stock market

collapse much worse than it had to be.

And just like 2007, consumer

credit is totally out of control. As I noted in one recent article, during the fourth quarter of 2013 we witnessed

the biggest increase in consumer debt in the U.S. that we have seen since 2007. Total consumer credit in the U.S. has risen by 22 percent over the past three years, and 56 percent of all Americans have “subprime credit” at this point.

Are you starting to get the picture? It is only 7

years later, and the same things that happened just prior to the last great

financial crisis are happening again. Only this time we

are in much worse shape to handle an economic meltdown. -----------

None of the problems that caused the last financial

crisis have been fixed. In fact, they have all gotten worse. The total amount

of debt in the world has grown by more than 40 percent since 2007, the too big

to fail banks have gotten 37 percent larger, and the

colossal derivatives bubble has spiraled so far out of control that the

only thing left to do is to watch the spectacular crash landing that is

inevitably coming.