Prime Minister Ab, who cannot maintain the administration unless postponing again he consumption tax hike, said at the G7 summit: “Another global risk.” … His true intention has been completely detected by overseas media.

Please read the following twitters one by

one from above. Although he had said “moderate economic recovery,” Prime

Minister Abe suddenly said, “the world is facing another global risk.” At this

rate, it is highly likely that he will suddenly cry out for draft system and

have Japan launch war. I am afraid of it.

Other leaders, who have almost the same

level of recognition ability about global situation as Abe-pyon, responded to

his remarks as if they had no idea what he talked about. Although he was made a

fool of by other leaders, “we agreed on the recognition that the global economy

faces a big risk,” Prime Minister Abe stressed. Other leaders were probably

astonished to hear his remarks.

I admire his genuine talent in that he can

lie so blatantly. However, according to the tweets below, his true intention

seems to have been detected.

The Abe administration has been put into

corner to such a degree that “Abe cannot maintain it unless postponing the

consumption tax hike. Nevertheless, I’m ashamed of Prime Minister Abe who made

a false step. However, the media seem to ignore it.

May

29, 2016

Masatoshi

Takeshita

国民には景気は回復に向かっているって言ってなかったけ?

「リーマン級のリスク」G7で溝 増税再延期の口実に?t.co/LuXrvbIBbe

— 藤原直哉 (@naoyafujiwara) 2016年5月27日

Noya

Fujiwara

@naoyafujiwara

Didn’t he say to the people that the economy

is moving towards moderate recovery?

“Another global risk” comment in G7 caused

disagreement. Excuse to postponing again

the consumption tax hike?

「緩やかな回復」との政府見通しがわずか3日で世界経済は危機的状況だとサミットで主張された安倍総理。が、驚くことに、その根拠となる資料を外務省は「どこが作ったかわからない」、内閣府は「見たことがない」と民進党のヒアリングで答えた。 t.co/b4tPixxmCC"

— 山井和則 (@yamanoikazunori) 2016年5月27日

Kazunori

Yamanoi

@yamanoikazunori

Prime Minister Abe claimed that the global

economy is in critical situation at the summit only three days after announcement

of the government’s outlook of “moderate recovery.”

Surprisingly, however, the Foreign Minister

answered “we don’t know who developed the material supporting PM’s remark” and

the Cabinet Office answered “We have never seen it” at a hearing held by the

Democratic Party.” twitter.com/tanakiyuichiro…

May 28, 2016

景気回復 この道しかないと言うからついていったリーマンショック前夜ってシャレにならへんやんか

このままついて行ったら知らん間に戦争にも巻き込まれんで よう知らんけど pic.twitter.com/WjbCr8DQWC

— ただの黒猫(横浜) (@Tomynyo) 2016年5月29日

Tada

no Kuro Neko (Yokohama)

@Tomynyo

Economic recovery, this is the only way. We

followed as LDP campaign promise says.

But we are on the eve of global crisis. No

kidding!

I’m not sure, but if we follow the

administration, we will get involved in a war before we know.

May 29, 2016 12:36

よくここまで真逆の嘘がつけるな!!

また、それをよく右から左へ報道するよな!!

本当、戦争中の大本営発表だ!!

安倍首相

「今回のサミットで、世界経済は大きなリスクに直面しているという認識については一致することができた」と強調。 t.co/EnACIS7FJP

— 昭和おやじ 【打倒安倍政権】 (@syouwaoyaji) 2016年5月27日

Syowaoyaji

[ Down with Abe administration]

@syowaoyaji

How dare he can tell precisely opposite

lie!

Don’t report it in a direction from right

to left!

It is really an announcement by the

Headquarters of the Imperial Japanese Army!

Prime Minister Abe

“In this summit, we agreed on the recognition

that the global economy faces a big risk,” he stressed.

mainichi.jp/articles/20160…

April 27, 2016 09:01

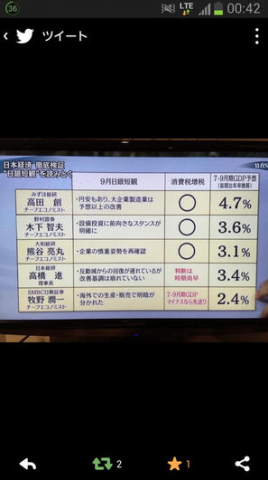

PM Abe: Consumption tax hike to be postponed again “Similar to the situation before the 2008

global risk”

On

26, PM Abe decided to postpone again a consumption tax

Hike

to 10% to be scheduled for April next year.

mainichi.jp

t.co/rUZqqmVLSr

←ほんと、これ恥ずかしい。まるで子供。浅はか。これで国民が信じるなんて。こっちがほんと。↓ pic.twitter.com/YXJMdOwEHj

— moca (@datsugenp) 2016年5月27日

Overseas

media point out

“Sign to postpone a

consumption tax hike”

German leading newspaper:

PM Abe tries to look for an excuse to

postpone the hike.

安倍晋三がG7で各国の財政出動を煽るために「世界経済はリーマンショックの前のような状況だ」と何度も発言したことを、フランスのルモンド紙は「安倍晋三がデマを流した」と報じています。あ~恥ずかしい!→ t.co/PWOoOdwgXS

— きっこ (@kikko_no_blog) 2016年5月27日

Kikko

@kikko_no_blog

At the G-7 meeting, to increase public

spending by counties, Shinzo Abe said many times: “The global economy is in the

situation before another global crisis.”

French Le Monde reports “Shinzo Abe spread

a false rumor.”

How shameful! lemonade.fr/economie-mondi…

May 27, 2016 21:47

L1alarmisme

de Shinzo Abe surprende le G7

Le chef du gouvement Nippon a mis en grade,

jeuddi, ses

Partenaires du G7 contre les risques d’une

nouvelle crise fianciere

Lemonade.fr

「伊勢志摩サミットで議長の安倍晋三首相が『世界経済の現状は2008のリーマンショック前の状況だ』と連呼した問題について、英紙フィナンシャルタイムズ紙は27日、『消費税増税を再延期しないと政権が維持できない安倍首相が、増税再延期のための理由として放った布石だ』と報じた」とのこと。

— きっこ (@kikko_no_blog) 2016年5月28日

Kikko

@kikko_no-Blog

“In the summit meeting held at Ise-Shima,

Prime Minister Abe, Chairman, repeatedly said “the current global economic

situation is the situation just before the 2008 financial crisis.” On 27, British

paper Financial Times reports: “Prime Minister Abe, who cannot maintain the

administration unless postponing the consumption tax hike, made a strategic

move by using his remark as an excuse to postpone the hike.

May 28, 2016 22:24

Arubiaka@15@alb_swan

Arubiaka@15@alb_swan