Mr. Kazuo Mizuno Warns: “Bank of Japan Voluntarily to Put An End to Capitalism This Year”

I have repeatedly explained about this scenario. It is likely that prices will rise several times or several score times, though hyperinflation may not occur. Since the BOJ can buy as much as government bonds, we will not see default. However, such price rise will lead to the collapse of people’s lives. It is de facto state bankruptcy. I have a feeling that the government is intentionally moving the trend toward such scenario. They might have an intention to start everything including the pension system from scratch. Hell is waiting for pensioners.

Masatoshi

Takeshita

January

3, 2014

English translation of the excerpt from a

Japanese article: Nikkan Gendai – January 3, 2015 –

Mr.

Kazuo Mizuno Warns: “Bank of Japan Voluntarily to Put An End to Capitalism

This Year”

“End of Capitalism and Crisis of History” (written by Mr. Kazuo Mizuno; published by Shueisha) was the best-selling new book on economy in 2014.

This is a classic book, which ranked first among Weekly Diamond “Best Economy Books” economist and economic experts selected by vote. How does the author who exposed the limits of capitalism see the Japan economy in 2015?

Asked about it, he gave a horrifying

prediction. “I write about the end of capitalism in this book. Whether I write

about it or not, I suppose that Japan’s economy after

2015 will show the very end of capitalism,” he says. We asked him to

explain in order.

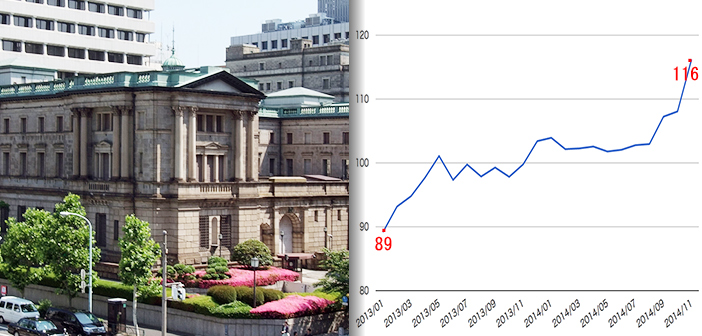

“The BOJ set a target of 2 percent of price

increases within two years. In April 2013, the bank shot the Kuroda bazooka

Round One as the first exceptionally easy monetary policy. However, prices did

not rise as much as expected and the second bazooka was shot in October 2014.

Although stock prices truly rose, global collapse in crude oil prices resulted

in a drop in gasoline prices and as a result, the 2 percent target has not been

reached. Probably, the BOJ will shoot the bazooka Round

Three in April 2015 and make desperate efforts

to further weaken the yen substantially. They are motivated to save

face. However, will such policy to induce a weaker yen lead to people’s affluent

lives? Even if they further raise prices with a weak yen, the real wages will keep on

falling as inflations goes on. I wonder for what purpose the BOJ

conducts its monetary policy. I think that the BOJ would have to face the

fundamental contradictions it has.”

Mr. Mizuno predicts that Japanese exchange rate will be one dollar to 125 – 130 yen. Real wage remains in negative growth due to inflation caused by yen devaluation. It is unbearable to ordinary people. What terrifies us is waiting in the wings.

“It is said that we

have no exit even now. If carrying our additional easing, the BOK will be

stuck in a difficult situation in which it cannot stop taking exceptionally

easy monetary policy until Japan’s economy collapses. It is because keeping monetary relaxation boosts asset prices such as

stocks or land. However, as soon as the BOJ

stops the monetary relaxation, such prices will take a great dive.

Naturally, the government presses the BOJ to “continue the relaxation” and BOJ

President Kuroda cannot go against the government’s intention and is forced to

continue to shoot the bazooka. Before long nobody will purchase

government bonds and the BOJ will have to buy up almost all of them.

Finally, it will be impossible to put price on government bonds because of no

market available for them. It turns out that we will see the end of capitalism.”

It is the Abe administration that shatters

everything.

If you want to understand how hyperiinflation works, read this and follow link at the end:

howfiatdies.blogspot.com/2014/08/positive-feedback-theory-of.html