On the Wrong Side of Globalization – Prescription for Betterment of Global Economy

Professor Joseph Stiglitz has criticizes the TPP. As read in the article, it appears that “the TPP talks have stalled.” Reading what Professor Stiglitz writes, however, it seems that he has not found an answer to the question of how to change the world economy for the better.

Using a simple example, I can illustrate

the current economy as follows. The

fruit of the people’s hard work is stolen by a very small number of big

business managers, politicians and bureaucrats who collude with one

another. How do they do? It’s very simple: such managers show favoritism

to politicians and bureaucrats by bribery, have them change the law to the

advantage of big companies and steal wealth from the people in the form of

tax. One such example is consumption tax

increase and refund tax applied to exporting companies.

They get richer with the wealth they have taken

away from the people without making any management effort and furthermore dabble

in gable (stock speculation) to build up wealth. Only a handful of the wealthy who keep on

succeeding in gambling build enormous wealth in this manner. Since they are acquitted with the government

insiders and trust their property to brilliant investors like George Soros,

they have very few risks of losing a bet.

Even if losing it, they are bailed out by the government and they are

practically free from any defeat. Like

this, they siphon wealth from the people.

It is hardly possible that such economy

will last forever. All we have to do to

create a booming economy is just to confiscate the income they illegally gained

and give it back to the people. How can

we do to prevent them from gaining such unfair income? The first thing we have to do is to fix the

maximum wage.

Could anyone on good

terms with Professor Stiglitz tell him about the above-mentioned very simple

prescription?

Masatoshi

Takeshita

May

23, 2014

Excerpt from a Japanese article: GendaiBusiness – April 21, 2014 –

On

the Wrong Side of Globalization by Joseph Stiglitz

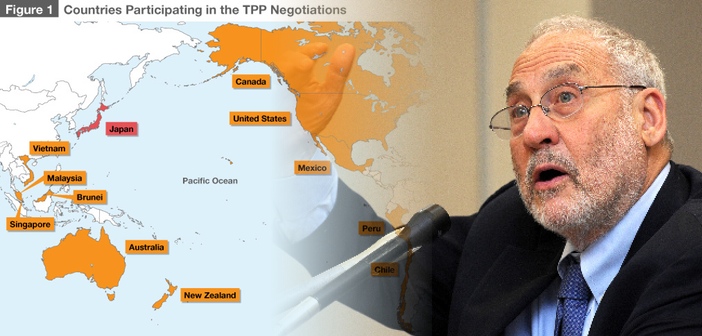

12 Trans-Pacific Partnership Member

Countries [Photo] The New York Times

Source:

Trade agreements are a subject that

can cause the eyes to glaze over, but we should all be paying attention. −−—−−

−−−−−− Most immediately at issue is the

Trans-Pacific Partnership, or TPP, which would bring together 12 countries

along the Pacific Rim in what would be the largest free trade area in the

world.

Negotiations for the TPP began in 2010, for the purpose, −−−−− , of

increasing trade and investment, through lowering tariffs and other trade

barriers among participating countries. −−−−−

Controversy has erupted, and

justifiably so. Based on the leaks — and the

history of arrangements in past trade pacts — it is easy to infer the shape of

the whole TPP, and it doesn’t look good. There is a real risk that it will benefit the wealthiest sliver of the American and

global elite at the expense of everyone else. −−−−− .

Let’s tackle the history first. In

general, trade deals today are markedly different from those made in the

decades following World War II, when negotiations focused on lowering tariffs. −−−−− .

Today, the purpose of

trade agreements is different. Tariffs around the world are already low. The

focus has shifted to “nontariff barriers,” −−−−− . Huge

multinational corporations complain that inconsistent regulations make business

costly. But most of the regulations, even if they are imperfect, are there for a reason: to protect workers, consumers, the

economy and the environment.

What’s more, those regulations were

often put in place by governments responding to the democratic demands of their

citizens. −−−−− But when corporations call for harmonization, what they really mean is

a race to the bottom.

−−−−− . Corporations everywhere may well

agree that getting rid of regulations would be good for corporate profits.

Trade negotiators might be persuaded that these trade agreements would be good

for trade and corporate profits. But there would

be some big losers — namely, the rest of us.

−−−−− . All over the world, trade

ministries are captured by corporate and financial interests. And when

negotiations are secret, there is no way that the democratic process can exert

the checks and balances required to put limits on the negative effects of these

agreements.

−−−−− . One of the

worst is that it allows corporations to seek

restitution in an international tribunal, not only for unjust

expropriation, but also for alleged diminution of

their potential profits as a result of regulation. −−−−− Philip Morris has already tried this

tactic against Uruguay,−−−−− . In this sense, recent

trade agreements are reminiscent of the Opium Wars,−−−−− .

−−−−− . Developing

countries pay a high price for signing on to these provisions, but the

evidence that they get more investment in return is scant and controversial.

And though these countries are the most obvious

victims, the same issue could become a problem for the United States, as

well. American corporations could conceivably create a

subsidiary in some Pacific Rim country, invest in the United States through

that subsidiary, and then take action against the United States government —

getting rights as a “foreign” company that they would not have had as an

American company. Again, this is not just a theoretical possibility:

There is already some evidence that compnanies are choosing hot to funnel their

money into different countries on the basis of where their legal position in

relation to the government is strongest.

There are other noxious provisions.

America has been fighting to lower the cost of health care. But the TPP would make the introduction of generic drugs more

difficult, and thus raise the price of medicines. In the poorest countries,

this is not just about moving money into corporate coffers: thousands would die

unnecessarily. -----. Trade agreements provide even more opportunities for

patent abuse.

The worries mount. One way of

reading the leaked negotiation documents suggests that the TPP would make it

easier for American banks to sell risky derivatives around the world, perhaps

setting us up for the same kind of crisis that led to the Great Recession.

In spite of all this, there are

those who passionately support the TPP and agreements like it, including many

economists. What makes this support possible is bogus, debunked economic

theory, which has remained in circulation mostly because it serves the

interests of the wealthiest.

-------------------- .

American politics today compounds

these problems. Even in the best of circumstances, the old free trade theory

said only that the winners could compensate the losers, not that they would.

And they haven’t — quite the opposite.-----

.

Critics of the TPP are so numerous

because both the process and the theory that undergird

it are bankrupt. Opposition has blossomed not just in the United States,

but also in Asia, where the talks have stalled.

----- .Those who see trade

agreements as enriching corporations at the expense of the 99 percent seem to

have won this skirmish. But there is a broader war to ensure that trade

policy — and globalization more generally — is designed so as to increase the

standards of living of most Americans. The outcome of that war remains

uncertain.

In this series, I have repeatedly

made two points: The first is that the high level of

inequality in the United States today, and its enormous increase during

the past 30 years, is the cumulative result of an array of policies, programs

and laws. -----. Agreements like the TPP have

contributed in important ways to this inequality. Corporations may profit,

and it is even possible, though far from assured, that gross domestic product

as conventionally measured will increase. But the

well-being of ordinary citizens is likely to take a hit.

And this brings me to the second

point that I have repeatedly emphasized: Trickle-down

economics is a myth. Enriching corporations — as the TPP would — will not necessarily help

those in the middle, let alone those at the bottom.